A straightforward, holistic approach to tackle ESG obstacles!

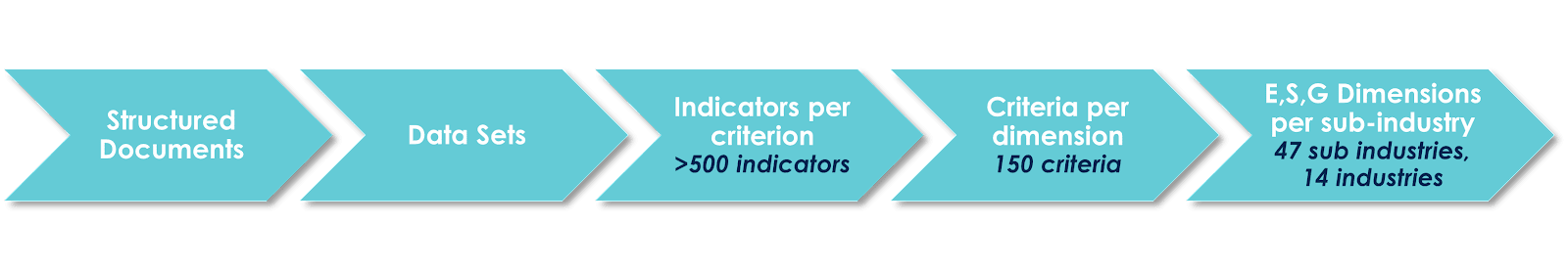

ESGenius! Ratings are designed to assess an entity’s resilience to long-term industry material environmental, social and governance (ESG) risks. ESGenius! uses a robust, scientific methodology developed in cooperation with major educational institutions.